For Listing Agents: How to Close with the Offer, Guide Sellers in Picking the Right Offer

Selecting the right offer when selling a home is a pivotal decision that can influence the Sellers entire transaction process.

With multiple offers often on the table, guiding sellers through this process is essential for maximizing their profits and ensuring a smooth sale.

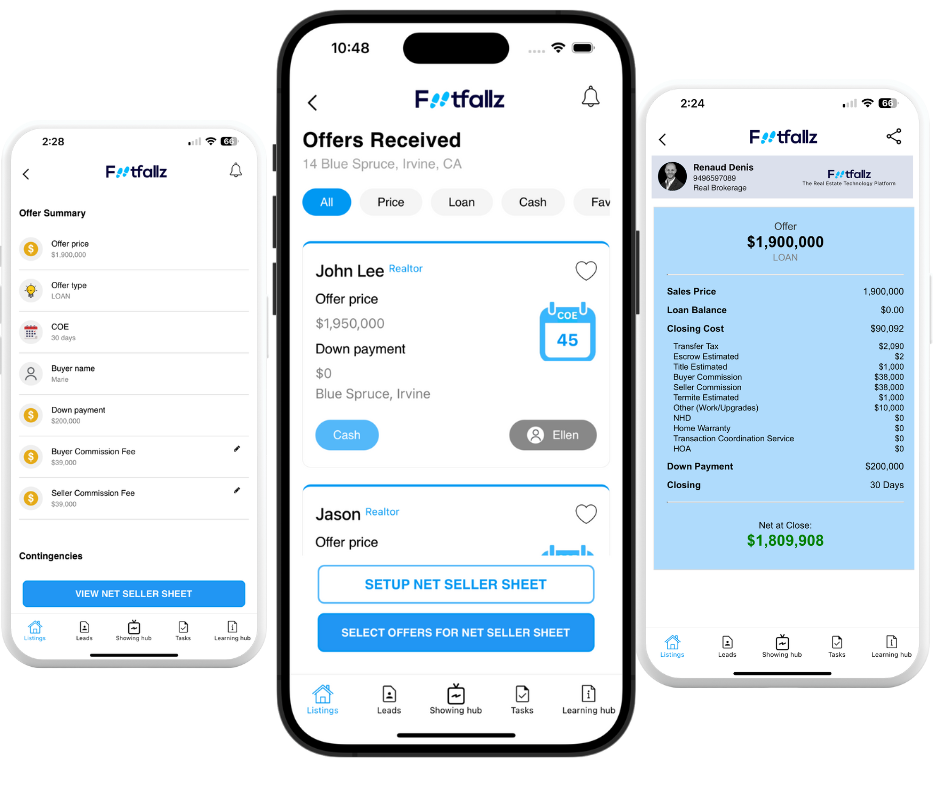

Footfallz OffersHub provides a robust platform designed to simplify offer management and enhance decision-making capabilities.

Here’s a detailed guide to help listing agents navigate the offer selection process effectively, utilizing insights and tools from Footfallz.

- Assess Financial Strength of Buyers

- Utilizing Footfallz OffersHub for mortgage pre-approvals and proof of funds

- Collaboration with lender partners for financial cross-clarifications

- Type of Financing

- Different financing options and their impact

- Proactive approach to address complexities

- Net Offer or Net Seller Calculation

- Importance of net seller calculation

- Automating the net seller calculation with Footfallz OffersHub

Behavioral Aspects of the Offer

- Cross Clarification

- Importance of direct communication with buyer’s agent

- Using Footfallz’s Mortgage Hub for financial validation

- Earnest Money Deposit Size

- Role of earnest money deposit in transactions

- Gauging buyer’s commitment based on deposit size

- Understand Buyer’s Motivation

- Importance of understanding buyer’s motivation

- Aligning seller expectations with buyer commitments

Handling Objections, Contingencies & Audits

- Review Contingencies

- Importance of assessing contingencies

- Prioritizing offers with fewer or less risky contingencies

- Consider Closing Timeline Flexibility

- Evaluating proposed closing dates

- Using Footfallz OffersHub for clear overview of closing dates

- Address Appraisal Gaps

- Importance of covering appraisal gaps

- Handling Escalation Clauses

- Benefits of escalation clauses in competitive markets

- Tracking escalation clauses with Footfallz OffersHub

- Meeting Document Retention Requirements

- Compliance with document retention rules

- Footfallz OffersHub saves offer documents for five years

- Buyer’s commission negotiation variations

- Capturing and recording commission agreements with Footfallz OffersHub

Financial Aspects of Offer

Assess Financial Strength of Buyers

Understanding the financial stability of potential buyers is paramount in mitigating risks and ensuring a successful closing.

Browse offer’s key points, financial documents, including mortgage pre-approvals and proof of funds. Reach out to your Lender partner and seek more clarifications and financial cross clarifications, to solidify offer’s financial strength

This helps listing agents with insights into the buyer’s ability to secure financing, reducing uncertainties and enhancing decision-making confidence.

Type of Financing

Different financing options available to buyers can significantly influence the smoothness and timelines of real estate transactions.

Whether buyers opt for Cash offer, conventional loans, FHA loans, VA loans, or other financing options, each type comes with its own set of requirements, timelines, and potential complications.

For listing agents, having access to detailed information on the type of financing each buyer intends to use is crucial. Aligning closely with the seller’s preferences and expectations.

By understanding the specifics of each buyer’s financing plan upfront, agents can proactively address potential complexities and negotiate terms that facilitate a timely and efficient closing.

This proactive approach not only minimizes surprises but also enhances transparency and communication between all parties involved in the transaction.

Net Offer or Net Seller Calculation

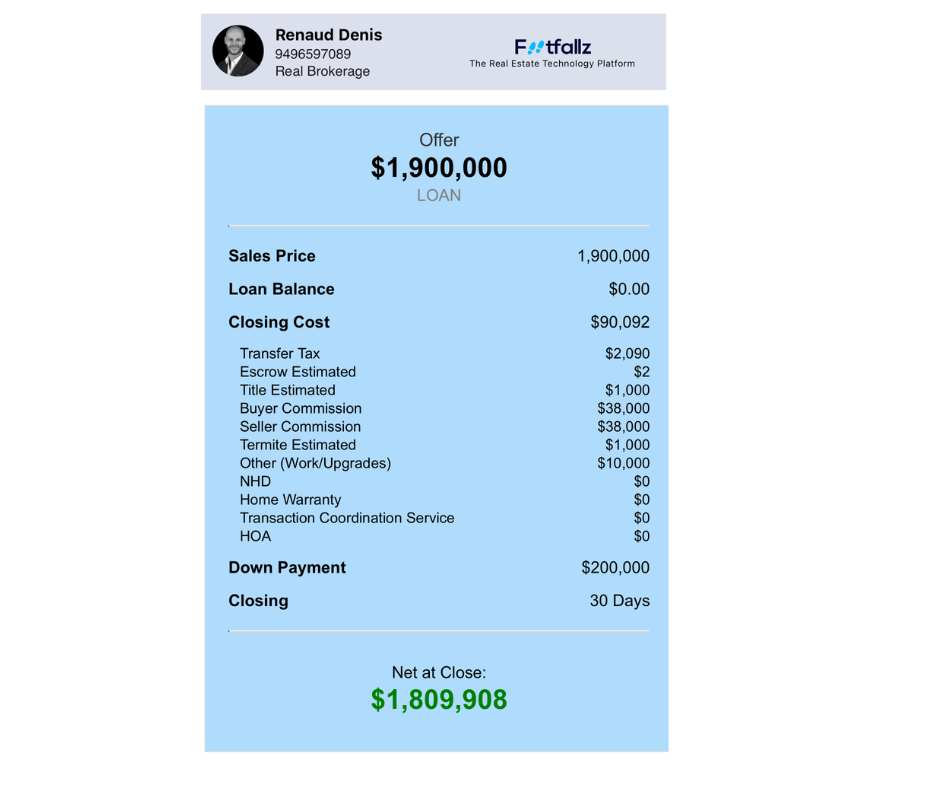

The net seller calculation is a vital tool for realtors and sellers when evaluating multiple offers on a property. It helps determine the actual proceeds the seller will receive after all expenses and fees are deducted.

This includes costs such as closing costs, agent commissions, repair credits, and other transaction-related expenses.

With the net seller calculation, realtors can quickly highlight which offers are more favorable financially. This tool allows sellers to see beyond the initial offer price and understand which offer will result in the highest net proceeds. It simplifies the comparison process and aids in making more informed decisions.

Footfallz OffersHub provides a comprehensive feature that automates the net seller calculation for each offer received. This tool allows realtors and sellers to input all relevant financial details and instantly see the net proceeds for each offer, making it easier to compare and evaluate multiple offers side by side.

Behavioral Aspects of the Offer

Cross Clarification

Before finalizing any offer, it’s crucial for listing agents to conduct thorough cross-clarification with the buyer’s agent.

This proactive step involves initiating direct communication with the buyer agent to clarify any uncertainties, address questions, and confirm the specifics of the offer.

By engaging in direct dialogue, listing agents can ensure all parties are on the same page regarding offer terms, contingencies, and timelines, thereby reducing the risk of misunderstandings or discrepancies during the transaction process.

Furthermore, sharing contact information with the paired lender or utilizing tools like Footfallz’s Mortgage Hub plays a pivotal role in solidifying the transaction’s foundation.

Verifying financial pre-approvals promptly through these channels not only validates the buyer’s ability to secure financing but also instills confidence in the transaction’s reliability.

This collaborative approach fosters transparency and efficiency, laying the groundwork for a smooth and secure real estate transaction that benefits both sellers and buyers alike.

Earnest Money Deposit Size

The earnest money deposit plays a crucial role in real estate transactions as it demonstrates the buyer’s financial commitment and seriousness towards purchasing the property.

This deposit, typically held in escrow, signifies the buyer’s willingness to proceed with the transaction and serves as a financial safeguard for the seller.

This transparency enables agents to accurately gauge the level of commitment from potential buyers and advise sellers accordingly on the strength of each offer.

Agents can differentiate between offers based on the size of the deposit, helping sellers prioritize offers that reflect a higher level of seriousness and financial capability.

Understand Buyer’s Motivation

Understanding why a buyer is interested in purchasing a particular property provides critical context that goes beyond financial terms.

Whether a buyer is looking for a family-friendly neighborhood, investing in a growing market, or seeking specific features in a home, understanding these motivations allows agents to highlight the property’s unique selling points that match the buyer’s desires.

This personalized approach not only strengthens the agent-client relationship but also increases the likelihood of securing a successful and satisfying transaction for both parties involved.

Handling Objections, Contingencies & Audits

Review Contingencies

Importance of Assessing Contingencies: Contingencies are critical clauses in offers that can significantly impact the transaction process. They outline specific conditions that must be met for the sale to proceed, such as home inspections, financing approval, and appraisals.

Agents can provide sellers with a clear understanding of how different contingencies might affect the sale. This proactive approach ensures that sellers are well-informed and can make decisions that align with their financial and logistical goals.

Prioritizing Favorable Offers: Agents can use OffersHub to guide sellers in prioritizing offers with fewer or less risky contingencies. This helps in selecting offers that are more likely to proceed smoothly and without delays.

Consider Closing Timeline Flexibility

Evaluating the proposed closing dates in each offer is crucial for listing agents to ensure a smooth transaction process that aligns with the seller’s timeline.

Different offers may present varying closing dates, and it’s essential to consider the flexibility of these timelines in relation to the seller’s preferences and logistical needs.

OffersHub, integrated within Footfallz, provides listing agents with a clear overview of offers that offer flexibility in closing dates.

This feature allows agents to highlight and prioritize offers that can accommodate the seller’s schedule effectively, minimizing potential logistical challenges and ensuring a more seamless transition for all parties involved.

Address Appraisal Gaps

Offers that include provisions to cover appraisal gaps play a crucial role in mitigating risks associated with discrepancies between the offer price and the appraised value of a property.

In real estate transactions, appraisal gaps can occur when the appraised value of a property is lower than the agreed-upon purchase price.

This situation can potentially lead to financing challenges and delays unless addressed upfront.

Handling Escalation Clauses

Offers that include escalation clauses are designed to automatically raise the offer price in response to competing bids, which can be advantageous in competitive real estate markets.

Footfallz OffersHub provides listing agents with the capability to track escalation clauses within offers, allowing them to monitor bidding wars closely.

This feature enables agents to stay informed about the evolving competitive landscape and advise sellers on how to manage these offers strategically.

By leveraging OffersHub to monitor escalation clauses, listing agents can guide sellers effectively in navigating competitive bidding scenarios to maximize sale prices.

Agents can provide insights into when and how to counter offers, manage negotiations, and capitalize on the heightened interest generated by escalation clauses.

This proactive approach not only helps sellers achieve optimal financial outcomes but also demonstrates the agent’s expertise in leveraging market dynamics to their clients’ advantage.

Meeting Document Retention Requirements

Different rules govern the retention of offer documents, often requiring them to be saved for several years.

With Footfallz OffersHub, this condition is met instantly, as the platform saves offer documents for 5 years, ensuring compliance with regulatory requirements and providing a reliable reference for future needs.

Impact of New NAR Settlement:

With the new National Association of Realtors (NAR) settlement, buyer’s commission will be negotiated, and negotiations can vary with each individual offer. Capturing this information in one place is crucial.

Footfallz OffersHub allows realtors to record and account for different buyer’s commission agreements, ensuring that all financial aspects of each offer are considered in the net seller calculation.

Conclusion

Guiding sellers in selecting the right offer requires a strategic approach that considers various factors crucial to a successful transaction.

By empowering sellers with comprehensive data and facilitating informed choices, real estate professionals can enhance client satisfaction and achieve successful and profitable transactions.

With Footfallz OffersHub, listing agents can leverage tools and insights to streamline offer management and ensure optimal decision-making.

Explore the transformative capabilities of Footfallz OffersHub today to elevate your offer management process and deliver exceptional results for your clients.

Visit Footfallz OffersHub for more information on how you can maximize your real estate business potential.